Should I get a new launch or a resale property?

13 Oct 2021

When considering a private condominium purchase today, many usually have a certain set of preferences whether it be new launch or resale, 99-year leasehold or freehold. More often than not, this decision is based on emotional needs rather than rational ones. Some see property as more of a place they can call home while others see property more as an investment tool. While not everyone is necessarily out to make a profit, most people would definitely not want to lose money from their purchase, which may happen if we purely rely on emotions to make the biggest asset decision of our lives.

One big question on peoples’ minds, especially with the increasing price gap between resale and new launches, would be whether new launches are still a viable investment option for them. To begin, we would like to start by saying the answer is rarely so straightforward, however, we do have several guidelines to safeguard our downside risks, ensuring we are making the best choice for ourselves and our families.

Time Horizon and Objective

First and foremost, it is important to consider our time horizon and objective. If we are looking to hold our property for a long period of time (say 10 years or more) and looking for a place purely for own-stay, it is possible to consider both new launch and resale properties.

However, if we have a shorter time frame and part of the objective is to enjoy some capital appreciation within the shortest possible time, then new launches may present better opportunities for such a case.

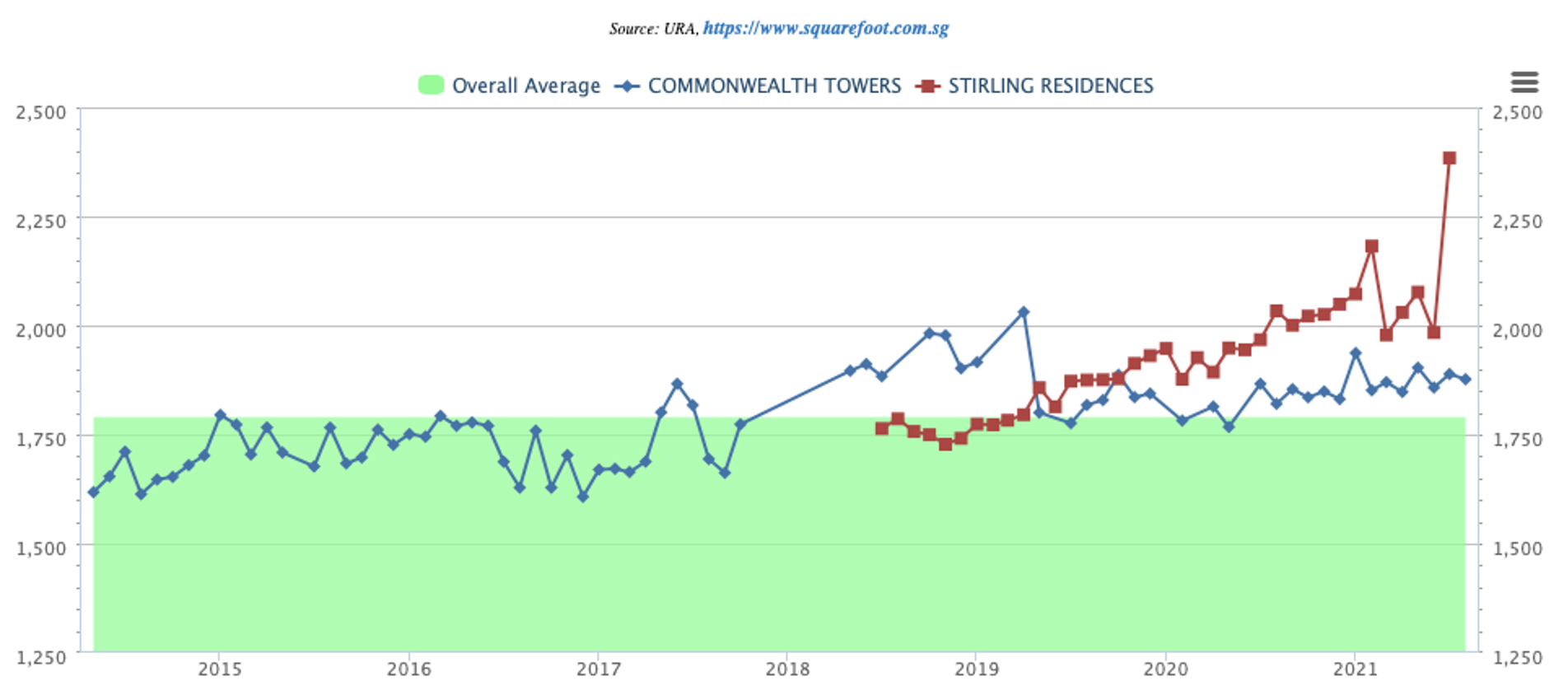

Chart A: Two new launches in Queenstown

a. New Launches

There are a couple of ways new launches provide such opportunities. One, especially if the development is sizeable, new launch prices tend to be staged up by developers over time. Let’s just take a look at an example of Stirling Residences in Chart A. Buying into Stirling Residences at the $1750 psf range back in 2018 during the launch phase would have made the first owners over $300 psf in paper profits just by developers pricing units sold later more expensive than before.

Two, intense activity tends to happen close to completion dates of new launches as there are buyers who prefer not to wait or rent while waiting for their property to be built, get something brand new, and don’t mind paying a premium for it. Hence the surge in demand will also give us an additional boost in our property value. Thirdly, payments for new launches are collected progressively, i.e. you only pay up to the extent your property has been built to. Comparatively, for resale properties, the full payment is made right from the start. This means that our return of investment when annualized tends to be higher for new launches even if both properties appreciate equally, as the capital outlay is smaller.

b. Resale Properties

For resale properties, one has to first understand that we are not entering into the property at the lowest entry point. Let’s look at some strong performing developments in the Bukit Timah vicinity on chart B, we see that if we were to purchase any of these developments in Year 2021, we would be entering in at twice of what the previous owner purchased for ten years ago. An important question we ask ourselves is, where are prices likely to move from here?

If our primary objective is for own-stay, we’ll still have to think about entry at a safe level, as there are costs involved which tends to add up to over 10% of our purchase price for us to breakeven. These include financing, stamp duties, renovation, property tax, just to name a few without including the Additional Buyer’s Stamp Duty if required.

While we may find older condominiums to be at a lower psf, we also have to consider the age of the building as well as lease decay (if it’s a leasehold property), such as the example in Chart C. If we put Queens, a 20 plus year old condominium, next to the brand new Stirling Residences, we see that prices have already stagnated from 2014 to 2021, and if we bought in thinking it’s priced at a discount to the new launch, then we would have been drooling at the sweet $300 psf increase in prices our neighbours have gotten in a matter of two years. Additionally, as a building gets older, one also has to provision for additional costs required to repair and restore both the building as well as your unit itself.

Budget and Affordability

While it’s nice to have a brand new condominium, or perhaps slightly more space in an older resale unit, it’s always important to consider our affordability or what we plan to set aside for our property purchase. This helps us to be in sync with our primary objectives and narrow down our options to find out if our criteria are practical to begin with. For example, if we have a budget of $1 million and would like a three bedder new launch condominium, our only option currently would be an Executive Condominium (which is a hybrid of public and private housing).

Chart B: 3 Resale properties in District 21 Bukit Timah

Chart C: Resale vs new launch in Queenstown

By understanding our objectives, we can better decipher our needs and practical concerns such as distance from transport networks, proximity to schools and amenities, or even our favourite hawker centre. With regards to affordability, one also should consider that for resale properties, the bank will need to assess the property’s valuation in order to disburse the loan amount, which may result in cash over valuation if the property ends up to be valued less than its selling price. For new launches on the other hand, the bank is almost always able to match its valuation.

For resale properties, the Buyer’s Stamp Duty and Legal Fees have to be borne by cash while for new launches, they can be borne by either cash or CPF. Furthermore, resale properties require full payment soon after exercising the option as compared to New Launches where payment is made progressively as the building is being constructed.

How Do We Identify Value-Buy Resale Properties?

So, how do we identify resale projects that will still make a comparative profit to new launches, albeit being less pronounced and noting only a handful do have such potential? We shortlist them via a couple of characteristics:

a. Freehold or Freehold equivalent tenure

Refer to Chart B which shows three freehold condominiums and their performances even after 15 years and compare it with Chart C which shows the stagnation of prices in the past 9 years of Queens, a leasehold project. While both suffer from aged design of building, the freehold project is sheltered from the lease decay factor. Freehold land also tends to be scarce as they are no longer released by the government.

b. Large plot of land

A large plot of land compared to boutique developments tend to hold its value or provide capital appreciation better as there is a higher likelihood for a greater volume of transactions in the resale market, hence room for prices to trend with the market rather than being stagnant.

Chart D: Price gap between new launch and resale in District 10 Bukit Timah

c. Big price gap between new launch and resale

If there is a huge price gap between new launches and resale – we see this especially in the Core Central Region where price gaps can go up to $800-1000 psf, there is a higher likelihood of resale demand holding up as there is a safe entry level at a lower budget (see difference in the two resale properties in Chart D: The Tessarina and Fifth Avenue Condominium compared to new launch RoyalGreen).

This is especially so when the locality is attractive, within close proximity to reputable schools, and/or near the MRT station and amenities.

d. Resale development should not be too old

It is worth noting that facilities and amenities do get outdated as the years go by, and older condominiums rarely have the modern amenities such as smart home systems compared to new launches, except of course if the MCST procures it with the consent of the committee. Buildings age too, which requires dipping into the sinking fund to spruce up the property, and not to forget the efficiency of layouts where newer condominiums tend to have more efficient layouts without excessive bay windows or yard areas.

How do we enter into a new launch property?

Of course, there are also many examples when new launches don’t see the startling performance as we saw above, hence there are certain methodologies we use to identify new launches that tend to outperform resale properties.

a. Entry price vs other units in the same development

By and large we try to help buyers enter the development at the most opportune time, usually during launch date itself, although there are circumstances when prices have not been staged upwards or the developer releases stacks at different stages in time. In choosing a stack with a premium pricing due to its facing or level, we tend to go for a more conservative approach. For example, not paying a premium price for too high a floor, so as to maximise profits when selling, as we’d also have to consider if potential buyers in the future would buy it from us at a premium too.

b. Entry price vs surrounding resale developments

We also consider surrounding developments and ensure we are not going in at a price that is too much higher from the condominiums around the area, taking into consideration factors such as proximity to amenities and MRT stations.

c. Limited supply of new launch developments in the area

When we assisted our client with a new launch, One North Eden, one of the key considerations was that there had not been other new launches in the Buona Vista area over the past decade. Furthermore, the demand in the vicinity was well over its supply, due to factors such as schools, offices, MRT and /amenities. True enough, One North Eden sold 85% of its units in the first weekend of its launch.

d. Transformation in the area

Studying the URA Masterplan helps us to map out future developments in the vicinity, which could potentially influence the value of our property. For example, will there be future commercial hubs with ready tenant pools to rent from me if I am looking at an investment property? Or do I have a first mover advantage for my residential property, with future residential plots likely to be sold at higher prices, hence elevating the value of my property in the resale market?

Additionally, we also identify transport networks such as upcoming MRT stations, future integrated transport hubs, or recreational and ecological installations such as the Bukit Timah – Rochor Green Corridor that provides leisurely access by foot from Bukit Timah all the way to Kallang Riverside Park. Early entry into properties before the MRT networks have been formed, such as at the Thomson East Coast Line, or Cross Island Line, allows us to enjoy the transformation and appreciation in value.

e. Low developer margin

While developer’s margins are getting thinner due to rising construction costs among other factors, having a sense of their profit margin allows us to assess the buffer we have when evaluating the intrinsic value of a property. This is done by taking into account costs the developer purchased the land for, adding in factors such as construction costs, financing costs, professional/legal fees/taxes, marketing and miscellaneous costs, assessing the sellable area and number of units that can be built based on the plot size and ratio, and finally, a 15-20% margin for the developers, since well, everyone has to feed their families somehow. We know we are not overpaying for our property if the selling price is not too far off from this estimate, hence able to maximise our potential return.

As the points above are not exhaustive, and there are many other factors to take note of when deciding on the various options available, do drop us an email or have a chat with us today to find out more about our entry and exit strategies, as well as further analyses of the market!

Disclaimer:

All information presented is based on personal opinion and research. STL Properties is not liable for any loss or expenses relating to investment decisions made by the reader. The opinions presented here are for reference and educational purposes only.