Five Investment Tips for New Launch Developments Own-Stay Buyers Should Look Out For

1 May 2021

You are buying a house for own-stay for the next 5-10 years, but you want to make sure that while falling in love with your house, you don’t lose money. Of course, it will be great if you make money! what are some of the things to look out for when choosing your new home?

1. Supply vs Demand

When we talk about supply vs demand, what do we mean? We look at the supply of private residential properties, which we will loosely refer to here as apartments or condominiums, of comparable characteristics vs the demand of buyers within that area. When purchasing value buy properties, we always want to have demand greater than supply in order to benefit from a price appreciation of our unit.

So what does it mean by apartments of comparable characteristics? Preferably, they must be of similar age, tenure (freehold or leasehold), size, quantum (price point) and location. For example, a person who loves to stay in new developments should not be comparing a development that recently TOP-ed with a development that is already 20 years old.

When we look at demand from buyers, what do we consider? We consider factors such as demand from HDB upgraders, proximity to reputable schools, proximity to work places, upcoming transformation in the area (which will be covered in the next point) and proximity to MRT Stations. The more factors checked, the safer the purchase, of course, there shouldn’t be an overwhelming number of options or competitors.

2. Transformation in the Area

Average psf of Paya Lebar from 2008 to 2020

Are there going to be new upcoming MRT stations near the area? Has the government announced any major development or redevelopment plans? Will there be major sprucing up? These are some things to consider when purchasing your next property. Very often when there is a major transformation in that area, prices tend to shoot up because buyers are optimistic about its future demand. Take for example, the Paya Lebar transformation. Under the 2008 URA draft master plan, Paya Lebar Central was identified as one of the commercial hubs to be developed outside the city centre. Much development has taken place in the last decade to transform that area, including the opening of Paya Lebar Square in 2015 and SingPost Centre two years later. Since then, that area has enjoyed an additional 150% increase in average psf (refer to the graph). This is compared to the modest 45% increase in average psf within the RCR region for the same period.

3. Potential Upside and Risk

How do we identify our potential upside and maximise it? How do we minimize our downside risk? One thing we could do is compare the price we are paying to the price being paid for the same type of development within the area as well as within the region, namely, Core Central Region, Rest of Central Region and Out of Central Region. For example, if we are considering a new launch condominium, we should look at the average psf for new launch projects within that particular region. If we are considering a project at a price that is below the average psf, or at the lower end of the range, that could help as an indication whether we are entering at a safe entry price.

How do we protect ourselves from any potential downside risk? We can take a look at the price that the developer bought the land at and estimate the developer’s breakeven cost based on estimated land (including Development Charge/Differential Premium), construction, land financing, legal, taxes and marketing costs. Then from the listed price provided by the developer, we can reverse engineer the developer’s profit margin. The lower the profit margin, the better it is for you as a buyer because there’s a lower chance that the developer will slash the prices in the future just to sell out the units. A good safe gauge would be about 10-15% profit margin in current times.

4. Size of Development

Why does the size of development matter? There are two main reasons:

a. Prices of new launch condominiums are primarily determined by the developer

When developers first launch units for a substantially-sized development, it is common for them to launch in phases (i.e launch only certain stacks first) or launch all but stage up prices over time when they see a good demand for the development. Having a big enough development creates runway for developers to stage the prices. It also makes sense for them to do so, not just from a profit-based perspective, but also from an opportunity cost perspective. Typically, it takes about 3-4 years from launch for a development to achieve TOP. Buyers who are purchasing into a new launch at a later stage and closer to the TOP date need not wait as long as compared to buyers who purchased when it was first launched. Hence, they are more willing to pay a premium for the unit.

b. Prices of resale units are determined by past transactions

For resale developments, prices are very much determined by past transactions. When you buy into a decently sized development, there will be higher transaction volumes which will help prop up prices. Also, your selling price will likely be less affected by outliers. For example, if a seller decided to sell his unit at an undervalued price, in a development that has a higher transaction volume, potential buyers will identify this as an outlier and not be as influenced by his pricing.

5. First Mover Advantage

This point relates to the earlier point that developers tend to stage up prices over time from launch. It is important to purchase when the development is first launched because there is a higher chance that you will be buying in at the lowest possible price. While developers do at times slash prices, this is rare because they will incur the wrath of buyers who bought before that. That being said, is it possible to still enjoy capital appreciation of your property even though you were not the first mover? Yes, it is, but careful analysis must be done to ensure the entry price is still right.

Now, you may ask, which developments out there possess such qualities?

1. Parc Greenwich

Parc Greenwich is an upcoming EC at Sengkang, located along Fernvale lane, which will be launching in the second half of 2021. It will have 496 units ranging from 3 to 5 bedrooms, developed by Frasers Property Singapore.

Why Parc Greenwich?

a. Demand supported by BTO upgraders

There are three new BTOs nearby: Fernvale Glades (TOP Q3 2021), Fernvale Dew (TOP in Q2 2022), and Fernvale Vines (TOP Q1 2023). When they reach the end of their MOP, there is high chance these residents will be looking to upgrade to relatively newer condos within that area. This presents a healthy resale demand for Parc Greenwich, which is the newest Executive Condominium available.

b. Proximity to good schools

It is relatively close to renowned schools such as Nan Chiau Primary School, Rosyth School, Mee Toh School and CHIJ St Joseph’s Convent. Hence, there will naturally be a high demand for residential units within the area because parents would want to stay closer to their children’s schools for convenience.

c. Transformation at Seletar Aerospace Hub and Punggol Digital District

In 2018, then MTI’s minister S. Iswaran launched a new aerospace Industry Transformation Map (ITM) that could create 1,000 new jobs in the sector by 2020. While the COVID crisis could have slowed down the progress of this transformation, the aerospace industry is still marked as a key sector of growth as the Republic has to continue maintaining its status as Asia Pacific’s leading maintenance, repair and overhaul hub.

The 50-hectare Punggol Digital District is on track for completion from 2023. This new business district in Punggol is meant to chart the Government’s focus on the digital economy and create 28,000 jobs in the fields of cybersecurity and data analytics. It will incorporate a business park and the Singapore Institute of Technology’s new campus.

With major transformation happening within the vicinity, there will be ample resale demand from own-stay buyers.

d. Good sized development

This development will have 496 units, which is a decently-sized development, that could help create sufficient runway for the developer to increase prices and for resale units to be supported by robust resale transaction volumes.

With all the above factors in mind, one thing to take note of will be the price in which Parc Greenwich is launched. With Frasers’ breakeven being $998psf ppr, which was approximately the same as Ola, we can expect prices to launch at around the same pricing as Ola (which enjoyed a margin of about 14%).

2. Normanton Park

Normanton Park is located within district 5 within the Rest of Central Region off Ayer Rajah Expressway. The development comprises 1,862 units – 9 blocks of 24-storey building and 22 strata landed terrace with 8 commercial shops and 2 levels of basement carparks, swimming pool and communal facilities, developed by Kingsford Huray Development Pte Ltd. While Kingsford may not have had the best track record for a previous project, the standard imposed for Normanton Park to be allowed their sale license was much higher where all units had to pass BCA’s Quality Mark assessment before they can apply for TOP. This is rare for developments and it is the highest mark of assessment for workmanship, so one can be reassured Kingsford will have to ensure this project meets or exceeds specifications.

Why Normanton Park?

a. Good location

While it is true that the place is not within walking distance to MRT stations, if you have a car, you are basically at the city fringe and will be able to get to the east or the west quickly since AYE is just at your doorstep. Malls and amenities such as Ion Orchard, VivoCity, Star Vista and Ikea are less than 15 minutes’ drive from Normanton Park.

b. Transformation at Greater Southern Waterfront and One-North

South of Normanton Park lies the Greater Southern Waterfront, where upcoming roads will eventually connect to. The Greater Southern Waterfront transformation was first announced in 2013. It comprises 30km of coastline stretching from Gardens by the Bay to Pasir Panjang. There will be more private and public housing options, office spaces and recreational and entertainment venues for residents. North of Normanton Park is the greater One-North region, which is a project undertaken by JTC and has a planning area of 600 hectares, providing more than 120,000 jobs and accounting for 5% of Singapore’s employment. Based on the Master Plan, there are still many plots of land marked for Business Parks within the One-North region that have yet to be planned.

This presents an opportunity for Normanton Park’s value to increase significantly as transformation takes shape over the years.

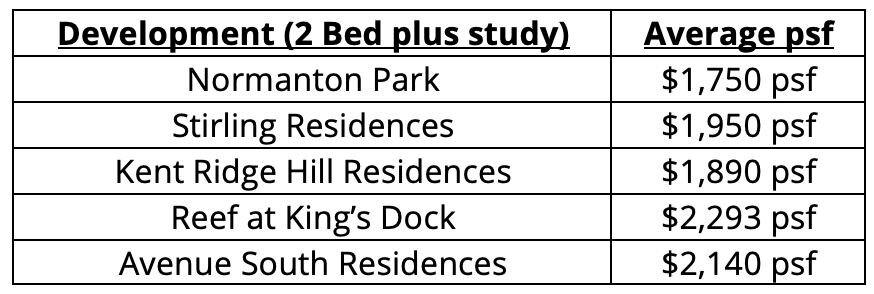

c. Current prices are undervalued compared to other developments in the area or the Rest of Central Region

Currently, Normanton Park’s prices are at approximately $1,750 psf, which is a very reasonable entry price for an RCR development. There are many developments in the area that have already transacted close to $1,9XX psf or more.

Furthermore, Kingsford paid $969psf for the land bid. Their breakeven is approximately $1,564psf. At a sweet pricing of $1,750psf, their profit margins are less than 15%. So, we know that we are entering at a price where there is a potential for appreciation.

d. Size of development

With over 1,800 units, Normanton Park is indeed a huge development. This gives opportunity for the developer to stage up the prices over time. There are lots of units to be sold, and they will usually release the units closer to breakeven prices at the start so as to cover their costs, get momentum going and gain confidence to start pricing higher as developers start to get their units sold.

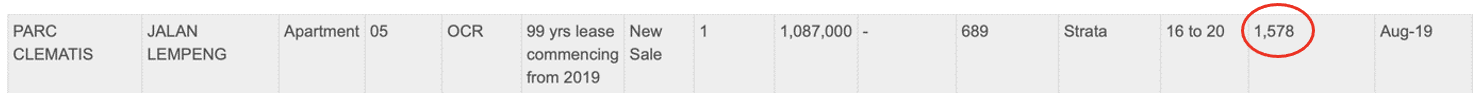

We give an example of a similar sized large development of close to 1,500 units, Parc Clematis, where we see at the launch in August 2019 a starting price of $1,578 psf for a 689 sqft unit around Levels 16-20:

In Dec 2020, more than a year later, a similar unit with the same size and level was selling at more than $100 psf than what it was at the launch:

And this month, we see yet another $100psf increase for a similar unit :

We can see how developers stage up their pricing which can climb in the range of $200-300psf even before the condominium is completed. For illustration purposes, we don’t compare the facing, but we know that facing differences do not command such a great differential.

In conclusion, we hope our findings have shed some light on our readers looking at new launch developments to purchase for own-stay. If you are keen to discuss more about your options, do drop us a message, and we can do a detailed analysis of your portfolio.

Disclaimer:

All information presented is based on personal opinion and research. STL Properties is not liable for any loss or expenses relating to investment decisions made by the reader. The opinions presented here are for reference and educational purposes only.