Copen Grand - Futuristic, Green, First-mover advantage

Introduction

Welcoming the First Executive Condominium (EC) in Singapore’s First Car-Free town Centre, Copen Grand boasts a whole lot of firsts in one of the most competitively priced new launches in a brand new town, Tengah — close to a new MRT station and Singapore’s second CBD.

A grand plan to create and transform a new town was conceived, similar to how Punggol and Sengkang was 15-20 years ago before the new BTOs and ECs were built. The difference is not just a more modern design and concept, but an attractive location in between two major areas of transformation, Jurong Innovation District and Jurong Lake District, as well as Singapore’s second CBD at Jurong East.

Artist impression of Tengah Town with underground roads for easy walking & cycling. Source: HDB

Tengah Town

Singapore’s first car-free town centre with a wide array of green elements such as Community Farmway and a 20-hectare Central Park that connects through housing estates

First HDB town planned with smart technologies right from the beginning. Designs of housing districts focus on sustainable features and community-centric spaces

Roads are planned to run beneath the town centre, freeing up space at the ground level for retail and recreational use. Residents will also have access to spaces for community gardening and farming

Providing 42,000 new homes across five distinct districts, each offering unique local features, Tengah sits alongside neighbouring Jurong Innovation District and Jurong Lake District with opportunities for Singaporeans to live, learn, work and play.

Jurong Innovation and Jurong Lake District

Jurong Innovation District is expected to account for more than 4,500 jobs within the next 18 months with big names such as Surbana Jurong and manufacturing plant, Shimano. Over 95,000 new jobs will be created when the advanced manufacturing hub is fully developed.

Jurong Lake District will be developed into Singapore’s next largest business district with 100,000 new jobs and 20,000 new homes by 2040 to 2050

Copen Grand stands to benefit from all these, being the first EC to launch in Tengah

Competitive Advantage

Besides having branded developers CDL & MCL, Copen Grand boasts being within a walking distance to Tengah Plantation MRT station, just 4 stops from Jurong East. We know how being close to an MRT Station in Singapore really sells, just looking at the sales of Provence Residences near to Canberra MRT, which had over half of their units sold within launch week. (View Fig 3)

Fig 3: News on Provence Residences’ launch sales. Source: Edgeprop

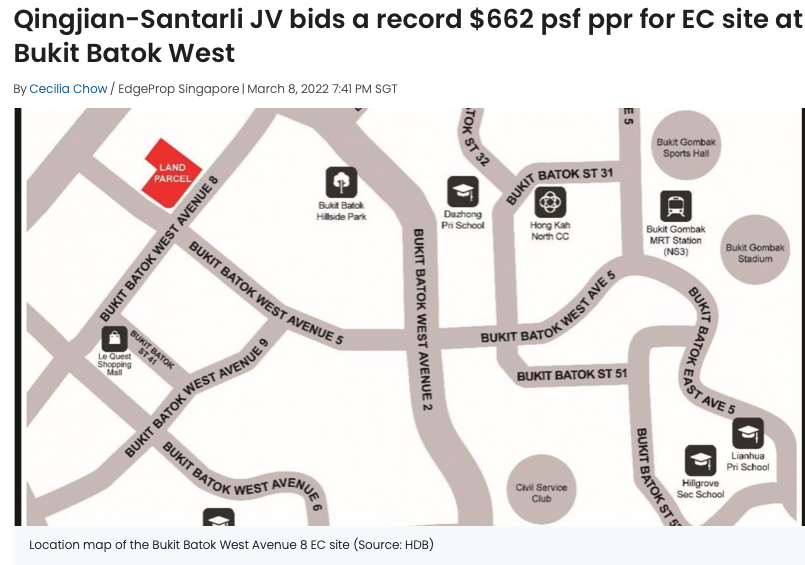

Fig 2: Bid prices for Bukit Batok West Avenue 8 & Tampines St 62. Source: Edgeprop

Pricing

The land Copen Grand sits on at Tengah Garden Walk, was purchased for $603 psf per plot ratio (ppr). By estimating everything from land cost, to construction, financing, professional and marketing costs, etc, we have an estimated breakeven price of $1059 psf ppr. With that, developers aim for at least a 15-20% profit margin, bringing the sale price within the range of $1250 - $1300 psf. (View Fig 1 for detailed breakdown)

We forecast this range to be palatable for a large range of households especially due to the depleted supply of new projects in the Out of Central Region especially at the quantum of $1-1.2m for decently sized three bedder units.

While Copen Grand’s prices seem desirable for a futuristic town close to Singapore’s second CBD, we want to ensure a safe entry by considering future EC plots. We derive that by analysing the next two EC launches, one at Bukit Batok West Avenue 8, and the other at Tampines St 62, both of which purchased their land at $662 and $659 psf ppr respectively, at least $50 psf higher than Copen Grand. (View Fig 2 for more information)

Artist impression of Jurong Lake District. Source: URA

Fig 1: Copen Grand’s breakdown of site and costs. Source: Edgeprop

Track Record of ECs and Future Potential

For many first timers and HDB upgraders, ECs are commonly seen as the ideal stepping stone in their property journey. They are deemed “best of both worlds” being a hybrid between public and private housing.

Apart from being priced more attractively than similar private condominiums, they also offer buyers a choice of alternative payment schemes, alongside various government grants.

Moreover, with bullish land bids of newer EC plots both at Tampines St 62 and Bukit Batok West Avenue 8, EC prices are expected to continue its upward momentum.

Let’s do a simple exercise to track 5 of the ECs that have recently or are about to reach their Minimum Occupation Period (MOP) ,with transactions in the resale market. You’ll see ECs such as Bellewoods at Woodlands, Lake Life at Jurong, Sol Acres at Keat Hong, Brownstone at Canberra and Rainforest at Choa Chu Kang, have all made a good profit of close to $400 psf from when they were first purchased. (View Fig 4 for chart)

A detailed breakdown on some other ECs around Singapore and their respective percentage gains can be found in Fig 5, with up to 64% of gains for Esparina Residences.

Artist impression of Jurong Innovation District. Source: JTC

Fig 4: Comparisons of 5 previous ECs that have recently or about to reach their MOP

Fig 5: Percentage gains and average transacted prices of previous ECs that have MOPed

Limitations of ECs

Apart ECs from being a low risk, high return investment, as an own-stay option, ECs tend to be larger and more functional in size, include decent amenities and facilities, and are usually located close to HDB estates, sustaining demand in the resale market from HDB upgraders.

However, there are points to take note before entry into an EC, such as eligibility according to HDB requirements, and a Minimum Occupation Period of 5 years before selling.

ECs are also usually located in Out of Central regions and other than Copen Grand and a few others, being situated close to an MRT station is usually rare.

Artist Impression of Copen Grands’s Swimming Pool and Multi-storey Clubhouse